Understanding Today’s Trading Landscape

In the fast-paced world of financial markets, having accurate data and timely insights can make the difference between a winning and a losing trade. Whether you’re a seasoned trader or just starting out, understanding how to interpret Forex Signals Results and conduct reliable Crypto Fundamental Analysis is vital to stay ahead of market movements. These two tools, when used effectively, can shape a more calculated trading strategy and improve decision-making.

Why Forex Signals Matter

Let’s start with signals. Forex signals are trade ideas or alerts that provide buying or selling opportunities in the currency markets. They are typically based on technical analysis, chart patterns, or news events. But the key is not just receiving signals—it’s understanding the quality and results they yield.

When evaluating Forex Signals Results, traders look for consistency and accuracy. It’s not just about a one-off lucky call. High-quality signals should be back-tested and have a record of profitable trades over time. This is where traders can gain confidence in their strategies, knowing that the data they rely on has a successful track record. The power of a reliable signal lies in its ability to cut through noise and guide traders to opportunities backed by analysis rather than emotion.

The Power of Analyzing Forex Signals Results

Checking the outcome of past signals allows traders to assess which systems or providers are worth trusting. For instance, how many signals actually hit their take profit targets? What’s the average return per trade? These kinds of questions help you build confidence in your tools and filter out the noise from less dependable sources.

That’s where platforms like Forex Visit come into play. By offering a transparent view into signal history, performance metrics, and risk-reward ratios, traders can make better-informed decisions and avoid costly guesswork. Reliable data leads to smarter strategy.

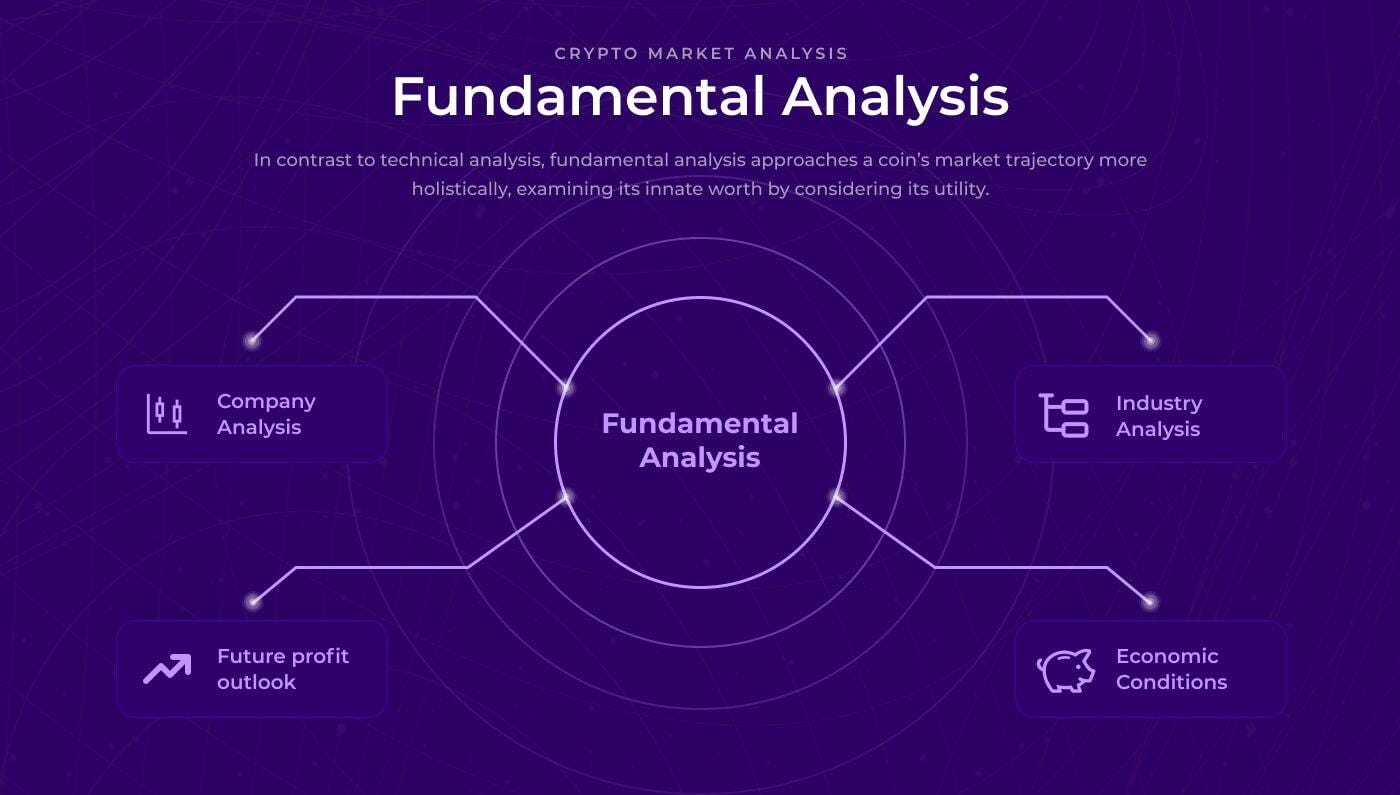

Delving into Crypto with Fundamental Analysis

While forex trading often relies heavily on technical indicators, the crypto space demands a slightly different approach. Volatility is the name of the game in digital currencies, which makes Crypto Fundamental Analysis a necessary companion to technical strategies.

Unlike traditional markets, cryptocurrencies are influenced by factors such as blockchain technology updates, network activity, development team decisions, tokenomics, and regulatory news. Traders who understand these elements can better anticipate market moves and evaluate the long-term value of a coin or project.

The Role of Crypto Fundamental Analysis in Long-Term Investments

Many newcomers to the crypto world dive in based on hype or headlines. But those who consistently find success tend to take the time to study the fundamentals. For example, what’s the use case of a particular coin? Is it solving a real-world problem? What does the development roadmap look like?

By integrating Crypto Fundamental Analysis into your research routine, you can avoid pump-and-dump schemes and focus on projects with genuine growth potential. It’s about developing a deeper understanding of what drives value and applying that knowledge to create a more robust portfolio.

How Forex and Crypto Strategies Can Work Together

The modern trader is no longer confined to one market. With digital platforms offering access to forex and crypto side by side, a blended strategy can often yield better results. For example, you might use Forex Signals Results to manage your short-term trades in major currency pairs while leveraging Crypto Fundamental Analysis to guide your longer-term positions in the digital asset space.

This hybrid approach helps diversify your risk and keeps you engaged across multiple opportunities. When market conditions are choppy in one arena, the other might be offering clear trends or new developments.

Tools That Can Make Your Journey Easier

Navigating the world of forex and crypto doesn’t have to be overwhelming. Platforms like Forex Visit serve as valuable allies, offering curated content, real-time insights, and tools that help simplify complex analysis. Whether you're looking for the latest in market-moving crypto news or historical data on forex signal performance, having it all in one place saves time and sharpens your edge.

Many traders find success not just through knowledge but through community. Engaging with a platform that offers forums, expert insights, and a variety of trading tools can help you avoid common mistakes and stay motivated during your trading journey.

Getting Started with the Right Mindset

Success in trading isn’t about luck—it’s about preparation, strategy, and ongoing learning. Whether you rely on Forex Signals Results to guide your currency trades or use Crypto Fundamental Analysis to explore new blockchain projects, having a disciplined approach is key.

Start by setting realistic goals, managing your risk properly, and taking time to review your performance regularly. The best traders are those who adapt, learn, and grow with the markets rather than trying to outguess them.

Conclusion: Trade Smarter, Not Harder

The financial markets are constantly evolving, and so should your strategy. By combining the power of signal tracking with fundamental research, you can build a trading approach that’s rooted in insight, not impulse. Whether you're focusing on forex, crypto, or both, success begins with the right tools and mindset.

If you're ready to take your trading to the next level, Forex Visit offers the perfect platform to support your growth. Explore signal results, analyze crypto fundamentals, and connect with a community that shares your passion for trading.