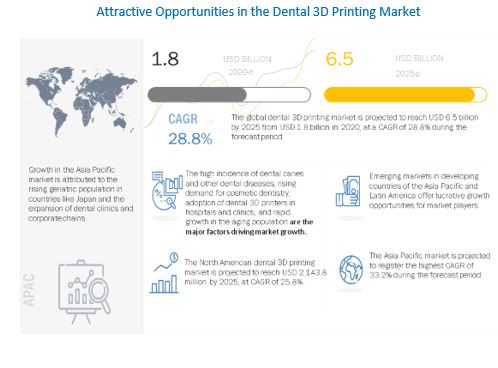

The dental 3D printing medical devices market is primarily driven by factors such as the high incidence of dental caries and other dental diseases, rising demand for cosmetic dentistry, the growing adoption of dental 3D printers in hospitals and clinics, and rapid growth in the geriatric population.

The dental 3D printing market was initially negatively impacted by the COVID-19 pandemic, as most dental offices, clinics, and laboratories were closed in many parts of the world due to lockdowns and quarantine restrictions in early 2020. This resulted in all non-essential dental procedures being deferred; the volume of outpatient cases reduced considerably in this period. However, recovery can be seen in most regions, especially North America and Europe, as dental services regain normalcy.

The Asia Pacific dental market has been slower to recover, especially in China and India. However, the drivers that had propelled 3D dental printing previously, such as the rising digitization of dental set-ups and the expansion of dental clinics and corporate chains, are still in place. This can be expected to promote the growth of the market in 2021–2022.

In an optimistic scenario, the need for smoother clinical workflows, faster turnaround times, and fewer dental appointments could boost market growth. Dentists may be more likely to invest in technologies like CAD/CAM and dental 3D printing to reduce the time taken to deliver dental appliances and treatment, and patients may be more likely to opt for these solutions for the same reason.

Dental caries or tooth decay is a common ailment across all age groups, with the global incidence of decayed and missing teeth (DMT) increasing dramatically in recent years. According to the CDC, in 2019, 64.9% of adults aged above 18 years of age had a dental examination or dental cleaning procedure. According to the American College of Prosthodontists, more than 36 million Americans are completely edentulous, and around 120 million Americans are missing at least one tooth.

One of the prominent barriers to the adoption of additive manufacturing or 3D printing is the lack of a skilled workforce. There is a very limited resource pool available for staff that is well-versed with 3D printing processes, which is further worsened by the rapid pace of evolution of the dental 3D printing market in terms of technology and materials.

There is a dearth of training programs available for additive manufacturing and a wide gap between academia and practical applications in the industry that is difficult to bridge. The lack of a well-qualified workforce would restrain the overall adoption of dental 3D printing.

Download PDF Brochure With Latest Edition @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=258228239

CAD/CAM is highly useful in customizing dental prosthetics, such as dental crowns made of zirconium. The use of CAD/CAM also reduces the need to wear temporary bridges/crowns during the course of the treatment and the number of doctor visits, thereby reducing the cost of dental restoration.

The cost of a high-resolution 3D printer is around USD 40,000 to USD 100,000. This also makes it difficult for laboratories dependent on federal funding (for whom securing funds in itself is a time-consuming process) to install and use such equipment. Due to this financial aspect, many smaller dental clinics may choose to outsource production to service bureaus or laboratories. This is poses a major challenge to the growth of the dental 3D printing market.

The equipment segment is further divided into dental scanners and printers. The large share of the services segment can be attributed to the competitive pricing offered by dental 3D printing service providers and the large-scale outsourcing of dental product design and production by small hospitals, dental clinics, and laboratories.

Get Data as per your Format and Definition | REQUEST FOR CUSTOMIZATION: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=258228239

Based on technology, the dental 3D printing market is segmented into VAT photopolymerization, fused deposition modeling, selective laser sintering, PolyJet printing, and other technologies.

The fused deposition modeling segment is projected to register the highest growth rate in the dental 3D printing market, by technology during the forecast period. In dentistry, FDM is a widely applied technology due to the availability of a wide range of biocompatible, strong, and sterilizable thermoplastics. The ability of the FDM machine to use several materials simultaneously makes it useful for printing removable dentures and prosthetics. Moreover, low machine and material prices also support their adoption.

On the basis of application, the dental 3D market is segmented into prosthodontics, implantology and orthodontics. Prosthodontics holds the highest share in the dental 3D printing market. The large share of the prosthodontics segment can primarily be attributed to the growing demand for crowns and bridges, rising prevalence of dental caries, increasing incidence of tooth loss, and increasing customer acceptance of advanced dental technologies.

In this segment, dental laboratories is projected to register the highest growth rate in the dental 3D printing market. The high growth rate of this segment can be attributed to rapid adoption of advanced dental technology by dental laboratories and consolidation of dental laboratories.