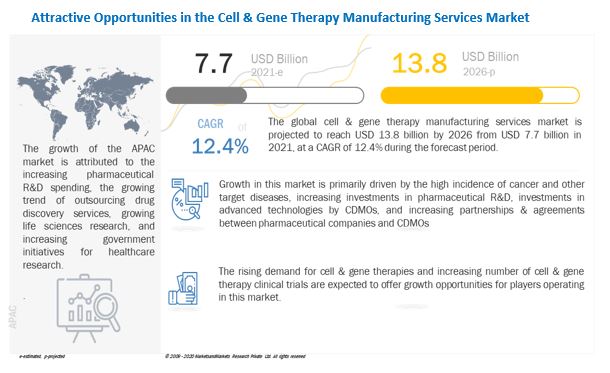

The global cell & gene therapy manufacturing services market size is projected to reach USD 13.8 billion by 2026 from USD 7.7 billion in 2021, at a CAGR of 12.4% during the forecast period. Growth in cell & gene therapy manufacturing services market is primarily driven by the high incidence of cancer and other target diseases, increasing investments in pharmaceutical R&D, investments in advanced technologies by CDMOs, and increasing partnerships & agreements between pharmaceutical companies and CDMOs.

However, the high operational costs associated with cell & gene therapy manufacturing are expected to restrain the growth of cell & gene therapy manufacturing services market to a certain extent.

The pandemic slowed the economic growth of various countries, including the US, Germany, the UK, India, and China. It also resulted in control measures that impacted operations in life science organizations, such as production and research. In an article published by Nature Biotechnology, the CEO of Flagship Pioneering (US) stated that lab productivity at many of its research-based setups was running at just 30–50% capacity, and even upholding that rate was a challenge.

According to GEP Worldwide, more than 1,200 clinical trials across the globe were disrupted by June 2020. Nearly 61% of clinical trials were disrupted due to the suspension of patient enrolment. The impact varied due to changes in COVID-19 case volumes throughout the year, but the worst effect was seen in April 2020. Trials involving respiratory disease, oncology, ID/anti-infectives, and cardiovascular disease were the worst-hit during this time.

Most pharmaceutical companies continue to invest heavily in the development of novel drugs and devices. The pharmaceutical industry, in particular, is R&D-intensive. Pharmaceutical companies invest in R&D to deliver high-quality and innovative products to the market.

Get Data as per your Format and Definition | REQUEST FOR CUSTOMIZATION: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=180609441

The trend suggests that the top pharma companies are increasing their R&D efficiencies through heavy R&D investments to see returns on their investment in the long run and through collaborative R&D efforts. According to an EvaluatePharma report, the worldwide pharmaceutical R&D spending was valued at USD 136 billion in 2012; this increased to USD 186 billion in 2019. With the impact of COVID-19, the global pharma R&D growth rate has dropped to 0.3% from 2019–2020.

As per report findings, this R&D spend is expected to grow steadily between 2019 and 2026 at a CAGR of 3.2% to reach USD 232.5 billion, slower than the historical CAGR of 4.6% between 2012 and 2019.

The increase in pharmaceutical R&D has resulted in a sharp increase in the number of cell & gene therapy candidates under development. This has made it necessary to outsource manufacturing services to develop cost-effective and efficient cell & gene therapies.

Currently, there are 1,200 cell & gene therapies in trials worldwide. There are more than 700 investigational cell & gene therapies in clinical development in the US alone. However, manufacturing facilities have not kept up. It has been estimated that hundreds of facilities will be needed to manufacture the treatments that are now in clinical trials. One of the areas that need to be accelerated is viral capacity.

Most viral vectors are produced using adherent manufacturing, which is expensive to operate—a vial of 20 million cells can cost USD 20,000 to USD 30,000 to make. The cost of manufacturing for gene therapy can be between USD 500,000 and USD 1 million, excluding the costs for R&D, the costs to run crucial clinical trials, or the costs to build the commercial infrastructure necessary to provide access to patients.

Download PDF Brochure With Latest Edition @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=180609441

According to a 2020 PhRMA report on the cell & gene therapy pipeline in 2018, there were 289 cell & gene therapies in clinical development by biopharmaceutical companies. This number increased by 25% in 2020, with 362 cell & gene therapies in clinical development. In addition to this, according to data released by CGT Catapult, there were 154 ATMP clinical trials ongoing in the UK in 2020 compared to the 127 trials reported in 2019, indicating an increase of more than 20%.

This significant growth in the number of cell & gene therapy clinical trials is expected to drive the demand for manufacturing services and, in turn, propel growth in the cell & gene therapy manufacturing services market.

This can primarily be attributed to factors such as increasing awareness about cell therapy, growing funding for new cell lines, increasing partnerships and acquisitions, and the development of advanced genomics methods for cell analysis.

Key Market Players

Key players in the cell & gene therapy manufacturing services market include Thermo Fisher Scientific (US), Merck KGaA (Germany), Charles River Laboratories (US), Lonza (Switzerland), Catalent (US), WuXi AppTec (China), Takara Bio Inc. (Japan), Nikon Corporation (Japan), FUJIFILM Holdings Corporation (Japan), F. Hoffmann-La Roche Ltd. (Switzerland), Oxford Biomedica plc (UK), and Cell and Gene Therapy Catapult (UK).