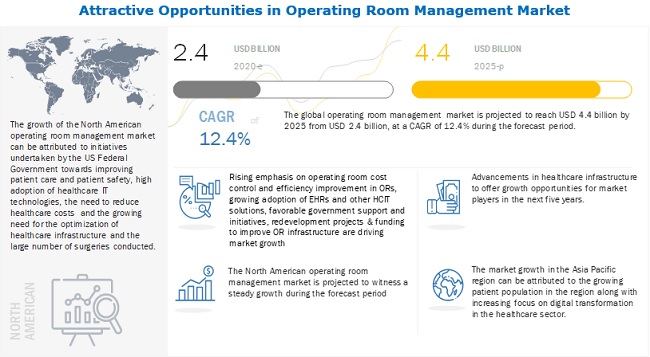

The global operating room management market size is expected to reach USD 4.4 billion by 2025 from USD 2.4 billion in 2020, at a CAGR of 12.4%. Growth in this market can be attributed to factors such as the emphasis on cost control and efficiency improvement in hospitals, growing adoption of EHRs and other HCIT solutions, favorable government support, redevelopment projects, and the availability of funding to promote OR infrastructure.

However, a dearth of skilled surgeons in integrated operating rooms and the high prices and maintenance costs of ORM software are expected to hinder the market growth.

The pandemic has led to a temporary ban on elective surgeries across the globe, which resulted in cancellations of elective surgeries worldwide. According to a report published by researchers of CovidSurg Collaborative, around 28 million surgeries were canceled across the globe during 12 weeks of peak disruption during the COVID-19 pandemic.

Download PDF Brochure With Latest Edition @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=175407912

To handle the increased surgical volumes, hospitals are increasing OR hours and focusing on better utilization of OR. The COVID-19 will positively impact the ORM software market. It will increase the adoption rate of ORM software as most hospitals will now focus on increasing capacity by using technology to improve efficiency.

The overall cost of healthcare delivery has grown significantly over the last few decades, mainly due to increasing health insurance premiums, the rising demand for quality healthcare services, rising geriatric population, and the increasing incidence of chronic disorders. Another important factor attributing to rising healthcare costs is the high dependency on traditional and outdated methods such as paper-based patient records, which leads to an increase in readmission rates, medical errors, and administration costs.

Operating rooms or ORs account for 40% of the total hospital expenses and constitute ~70% of the total revenue generated. Thus, the effective management of operating rooms by consolidating and organizing all patient data for the surgical staff during a procedure and streamlining information across multiple platforms is regarded as one of the key areas for reducing healthcare costs.

The adoption of ORM solutions has been particularly affected by its high installation and maintenance costs. ORM software, when once installed, also requires to be regularly updated as per the user’s requirement and software enhancements, thereby presenting recurring expenditure.

Additionally, the maintenance of high-end IT-enabled systems typically costs more than the software itself. The annual maintenance cost is estimated to be 20-25% of the initial cost of the software licenses.

Subsequently, it can be expected that the high costs incurred from the purchase, installation, maintenance, and upgrade of ORM software and solutions may negatively affect their overall adoption among end-users, thus restraining market growth to a certain extent.

According to the World Economic Forum, these emerging economies will account for around one-third of the global healthcare expenditure by 2020. More than half of the world’s population resides in India and China, owing to which these countries are home to a large patient base.

Get Data as per your Format and Definition | REQUEST FOR CUSTOMIZATION: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=175407912

Owing to the expansion of the patient population base, the number of hospitals and surgical centers is also expected to increase in emerging countries in the coming years. Also, currently, governments in these countries are undertaking initiatives to expand and modernize their respective healthcare infrastructures.

One of the major challenges for operating room management solutions is the consolidation of healthcare providers. The number of independent health care providers has been decreasing as most healthcare providers are turning to mergers, acquisitions, and partnerships and are functioning under a health system rather than operating independently.

On a 15-year basis, the percentage of hospitals functioning under a health system has increased from approximately 50% to approximately 65%. Today, over 70% of hospitals are operating as part of a health system rather than independently. This has led to few buyers in the market and may create an oligopsony condition, thus giving the buyers greater bargaining power, which may lead to an erosion of profit margins for operating room management solutions providers.

Data management communication solutions accounted for the largest share of the operating room management market in 2019 owing to the benefits such as easy sharing of patient status in perioperative care phases, tracking of the schedule compliance, and sharing of the media and information related to cases within different operating rooms or external hospital departments.