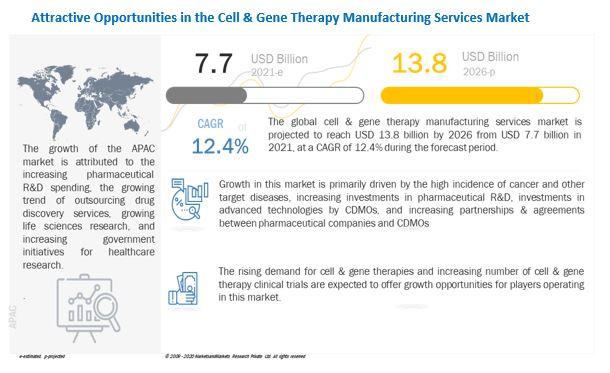

Growth in cell & gene therapy manufacturing services market is primarily driven by the high incidence of cancer and other target diseases, increasing investments in pharmaceutical R&D, investments in advanced technologies by CDMOs, and increasing partnerships & agreements between pharmaceutical companies and CDMOs.

Most pharmaceutical companies continue to invest heavily in the development of novel drugs and devices. The pharmaceutical industry, in particular, is R&D-intensive. Pharmaceutical companies invest in R&D to deliver high-quality and innovative products to the market.

According to an Evaluate Pharma report, the worldwide pharmaceutical R&D spending was valued at USD 136 billion in 2012; this increased to USD 186 billion in 2019. With the impact of COVID-19, the global pharma R&D growth rate has dropped to 0.3% from 2019–2020.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=180609441

The increase in pharmaceutical R&D has resulted in a sharp increase in the number of cell & gene therapy candidates under development. This has made it necessary to outsource manufacturing services to develop cost-effective and efficient cell & gene therapies.

Currently, there are 1,200 cell & gene therapies in trials worldwide. There are more than 700 investigational cell & gene therapies in clinical development in the US alone. However, manufacturing facilities have not kept up. It has been estimated that hundreds of facilities will be needed to manufacture the treatments that are now in clinical trials.

According to a 2020 PhRMA report on the cell & gene therapy pipeline in 2018, there were 289 cell & gene therapies in clinical development by biopharmaceutical companies.

On the basis of type, the cell & gene therapy manufacturing services market is broadly segmented into cell therapy and gene therapy. In 2020, cell therapy accounted for the largest share of the cell & gene therapy manufacturing services market.