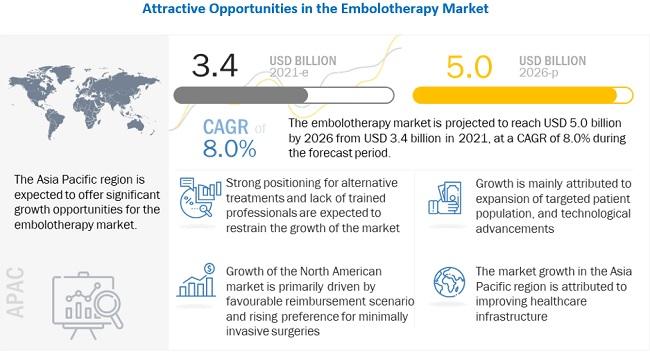

According to new market research report, "Embolotherapy Market by Product (Embolic Agents (Microspheres, Liquid Embolic Agents, Coil), Microcatheters), Indication (Oncology, Vascular, Aneurysm, Urology, Nephrology), Procedure (TACE, TARE), End-user (Hospital, Clinics, ASC) - Global Forecast to 2026", is valued at USD 3.4 billion in 2021 and is expected to reach USD 5.0 billion by 2026, at a CAGR of 8.0% during the forecast period.

The growth of the embolotherapy market is mainly attributed to factors such as the growth in the target patient population, rising preference for minimally invasive procedures, technological advancements in embolotherapy devices, and favorable reimbursement scenario.

The embolotherapy market is witnessing a loss of business, and the trend is expected to continue till December 2020. Unfavorable changes in regulations and guidelines are hampering the growth of this industry. Major regulatory authorities across the globe (such as CDC, WHO, MHRA, TGA, and EMA) have identified that cancer patients are at greater risk of COVID-19 infection than healthy adults.

The high success rate and less post-operative complication rate associated with embolotherapy procedures coupled with the rising incidences of liver cancer and hepatocellular cancer will further boost the demand for embolotherapy devices in the near future.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=185897830

The availability of effective conventional first-level therapies for the treatment of liver cancer, uterine fibroids, hemorrhagic stroke, and other hemorrhagic conditions is a key restraint to market growth.

The applications of embolotherapy continue to expand. Initially, embolotherapy was applied for uncontrolled gastrointestinal bleeding; in recent years, embolotherapy is being increasingly adopted for various indications such as non-operative management of solid tumors of the liver, spleen, and kidney; visceral and solid organ aneurysm.

Healthcare markets are witnessing a dearth of well-trained surgeons (including neurosurgeons and radiologists). The Association of American Medical Colleges (US) has estimated a deficit of 41,000 general surgeons in the US by 2025 (Source: Association of American Medical Colleges US, 2017).

Similarly, India is also facing an acute shortage of oncologists, radiotherapists, and surgical oncologists. With 1.8 million cancer patients in the country, there is only one oncologist to treat every 2,000 patients. The shortage of oncologists and radiologists in several countries worldwide is expected to affect the adoption of embolotherapy procedures.

The major players in the market include Boston Medical Corporation (US), Terumo Medical Systems (Japan), Medtronic (US), Johnson & Johnson (US), and Stryker Corporation (US). Other key players in the embolization therapy market include Sirtex Medical Limited (US), Abbott Laboratories (US), Acandis GmbH (Germany), Balt (France), Cook Medical (US), Kaneka Corporation (Japan), Penumbra, Inc. (US), Merit Medical Systems (US).