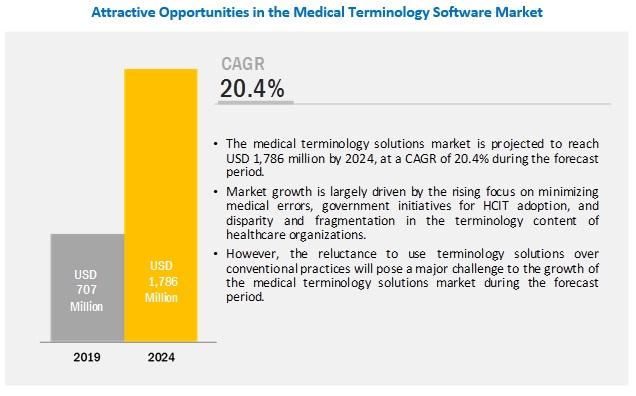

[138 Pages Report] The medical terminology software market is projected to reach USD 1,786 million by 2024 from USD 707 million in 2019, at a CAGR of 20.4% during the forecast period. The growth in this market is driven by factors such as the rising focus on minimizing medical errors, government initiatives for HCIT adoption, and disparity and fragmentation in the terminology content of healthcare organizations.

The large share of this segment can be attributed to the growing focus on reducing medical errors and the need to create a consistent and comprehensive data source and improve performance measurement and transparency in patient care.

On the basis of product & service, the services segment accounted for the largest share of the medical terminology software market in 2018. The large share of this segment can be attributed to the increasing demand for the standardization of patient data.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=239939409

The large share of North America is attributed to the high adoption of HCIT technologies, regulatory requirements regarding patient safety, the presence of leading market players in the region, and growing demand for accurate data exchange between healthcare providers and payers to streamline workflows.

Prominent players in the medical terminology software market are Wolters Kluwer (Netherlands), Intelligent Medical Objects (US), Apelon (US), Clinical Architecture (US), 3M (US), CareCom (Denmark), Bitac (Spain), B2i Healthcare (Hungary), BT Clinical Computing (Belgium), and HiveWorx (Ireland).

IMO terminology is used by more than 4,500 hospitals and 500,000 physicians daily. The company’s terminology software is used to capture clinical intent and help preserve and communicate complete patient information across the entire spectrum of care.