COVID-19 is an infectious disease caused by the most recently discovered novel coronavirus. Largely unknown before the outbreak began in Wuhan (China) in December 2019, COVID-19 has since moved from being a regional crisis to a global pandemic. With the World Health Organization (WHO) officially declared the outbreak of the virus as a pandemic, a mix of established pharmaceutical companies, as well as players in the bioprocess containers market, have stepped forward to develop treatments and vaccines that target the infection caused by the novel coronavirus. A few examples in this regard are:

- In March 2021, Pall Corporation (US) acquired Pall-Austar Lifesciences Limited (China), which is a joint venture established by Pall and Austar Group. This acquisition expanded Pall’s manufacturing capacity to primarily support the single-use technology supply chain demand in China in order to support the development of COVID-19 vaccines.

- In March 2021, Merck (Germany) invested ~USD 30 million (EUR 25 million) to add a single-use assembly production unit at its Life Sciences Center in Molsheim, France. With this expansion, the company is accelerating its European expansion plans for single-use technology, which is used for the production of COVID-19 vaccines and other lifesaving therapies.

Since most of the leading COVID-19 vaccine programs are using novel approaches, including mRNA, DNA vaccine, and vectors, these platforms are largely built on single-use technology. Most of the pandemic-related new facilities are largely engaging single-use systems due to their flexibility combined with high speed and much lower capital investment compared to traditional stainless steel equipment.

Therefore, the growing adoption of single-use technologies for COVID-19 pandemic-related research, coupled with increasing vaccine development by key players, is expected to have a positive impact on the bioprocess containers market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=107645832

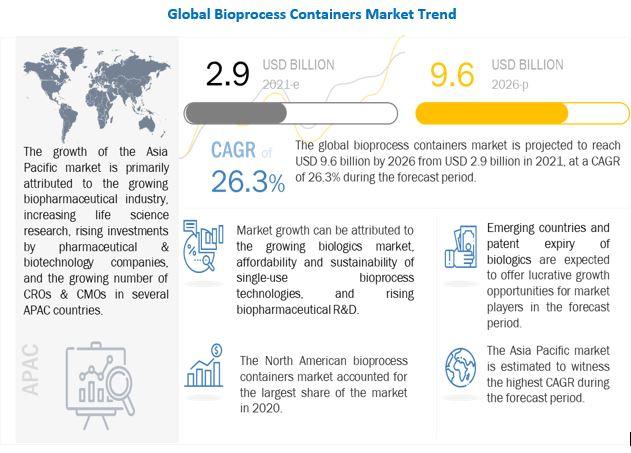

[216 Pages Report] The global bioprocess containers (BPCs) market is projected to grow from USD 2.9 billion in 2021 to USD 9.6 billion by 2026, at a CAGR of 26.3% during the forecast period. Growth in the bioprocess containers market is mainly driven by factors such as the growing biologics market, affordability and sustainability of single-use bioprocess technologies, and rising biopharmaceutical R&D.

The growth of single-use technologies can be attributed to the growing need for better, cheaper, and faster biologics production. Active development of individualized biologics and personalized medicines, including patient-specific cellular & gene therapies and therapeutic vaccines, demands high sterility and is therefore manufactured using single-use equipment and consumables.

Compared to traditional bio-manufacturing technologies, single-use systems (SUS) have many advantages, such as reduced requirements for process validation and higher manufacturing flexibility, which ultimately results in higher operating efficiency and reduced manufacturing costs.

According to a survey conducted by BioPlan Associates in 2018, 73.3% of respondents agreed that leachables and extractables are major concerns that may limit the use of bioprocessing in the near future. As single-use assembly products are made of processed plastic materials, they often face the problem of contamination from the container due to leachables.

The bioprocess containers market is dominated by a few globally established players such as Sartorius Stedim Biotech (France), Thermo Fisher Scientific (US), Danaher Corporation (US), and Merck Millipore (Germany).