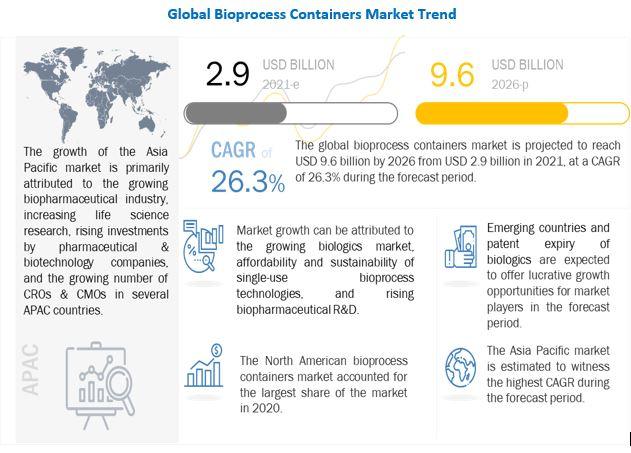

[216 Pages Report] The global bioprocess containers (BPCs) market is projected to grow from USD 2.9 billion in 2021 to USD 9.6 billion by 2026, at a CAGR of 26.3% during the forecast period. Growth in the bioprocess containers market is mainly driven by factors such as the growing biologics market, affordability and sustainability of single-use bioprocess technologies, and rising biopharmaceutical R&D.

According to a new market research report, "Bioprocess Containers Market by Type(2D and 3D Bags, Accessories), Application(Process development, Upstream and Downstream Process), End User(Pharma & Biopharma Companies, CMOs & CROs, Academic & Research Institute), & Region – Global Forecast to 2026".

On the basis of type, the bioprocess containers market is segmented into 2D bioprocess containers, 3D bioprocess containers, and other containers and accessories. In 2020, the 2D bioprocess containers segment accounted for the largest share of the bioprocess containers market. 2D bioprocess containers are frequently used in cell harvesting and for the transportation of bulk drug products and bulk drug precursors.

With the World Health Organization (WHO) officially declared the outbreak of the virus as a pandemic, a mix of established pharmaceutical companies, as well as players in the bioprocess containers market, have stepped forward to develop treatments and vaccines that target the infection caused by the novel coronavirus.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=107645832

The growth of single-use technologies can be attributed to the growing need for better, cheaper, and faster biologics production. Active development of individualized biologics and personalized medicines, including patient-specific cellular & gene therapies and therapeutic vaccines, demands high sterility and is therefore manufactured using single-use equipment and consumables.

In recent years, more biologics having higher potency that require smaller production volumes, advancements in biosimilars targeting smaller markets, and ongoing improvements in production yields and efficiencies that create production operations at much smaller scales have increased the use of single-use technologies such as single-use bioprocess containers/bags as they are best suited for small volume productions.

According to a survey conducted by BioPlan Associates in 2018, 73.3% of respondents agreed that leachables and extractables are major concerns that may limit the use of bioprocessing in the near future. As single-use assembly products are made of processed plastic materials, they often face the problem of contamination from the container due to leachables.

Some of the leading players operating in the bioprocess containers market are Sartorius Stedim Biotech (France), Thermo Fisher Scientific (US), Danaher Corporation (US), and Merck Millipore (Germany).