The COVID-19 pandemic has significantly impacted the buying capacity of hospitals, especially small-scale hospitals and scanning centers. According to an article in the Livemint, private hospitals in India have faced revenue losses of up to 90% due to the COVID-19 pandemic. The pandemic has also impacted the operation of manufacturing companies. Companies are functioning with a limited workforce. Moreover, the turnaround time for the delivery of products and services is affected due to newer packaging protocols and lockdown measures imposed by countries. All these factors are negatively impacting the manufacturing and supply chain of fluoroscopy products.

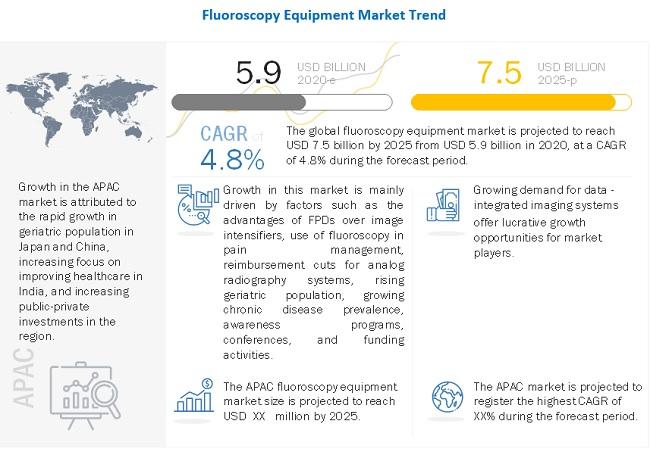

[187 Pages Report] The market for fluoroscopy equipment is expected to grow from USD 5.9 billion in 2020 to USD 7.5 billion by 2025, at a CAGR of 4.8% during the forecast period. Growth in the fluoroscopy equipment market is attributed to factors such as advantages of FPDs over image intensifiers, the use of fluoroscopy in pain management, reimbursement cuts for analog radiography systems, rising geriatric population, and the growing prevalence of chronic diseases.

The evolution of fluoroscopy systems and C-arms from traditional X-ray image intensifier technology to digital flat-panel detectors (FPDs) has brought about significant advancements in fluoroscopic imaging. FPDs have a number of advantages over image intensifiers, including compact sizes and reduced radiation dose.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=23056341

Although resolution varies from model to model, overall, FPDs have the ability to produce a more consistent and high-quality digital image. Moreover, while the quality of images generated from traditional image intensifiers deteriorates as the system ages, this is not the case with FPDs. They continue to deliver the same image quality even years after use and can provide a wider and more dynamic range of imaging compared to image intensifiers. Additionally, the field of vision reduces with higher magnification in the case of image intensifiers, which does not happen if FPDs are used.

FPDs offer no image distortion, greater sensitivity, and better patient coverage. Due to their advantages, many hospitals are now opting for FPD fluoroscopes. The growing preference for advanced technologies, and the need to shift to new, more efficient products, will be a key factor driving the growth of this market segment.

Many hospitals in developing countries are unable to invest in fluoroscopy equipment due to their high costs, poor reimbursement rates, and budget constraints, and therefore prefer refurbished systems. These systems are less expensive than new systems—approximately 40% to 60% of the original price.

The major players in the fluoroscopy equipment market are Siemens Healthineers (Germany), GE Healthcare (US), and Philips (Netherlands). These companies together accounted for a share of ~80% of the fluoroscopy equipment market in 2018. Other players in the market include Shimadzu Corporation (Japan), Ziehm Imaging GmbH (Germany), Toshiba Medical Systems Corporation (Japan), Hitachi Ltd. (Japan).