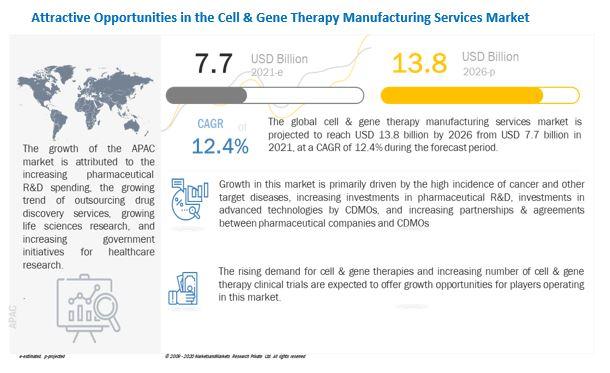

The development of therapies for key diseases, such as cancer, has attracted significant attention. Furthermore, increasing investments of pharmaceutical companies in the development of novel drugs is also fueling the market growth. However, significant operational costs are expected to negatively impact the cell & gene therapy manufacturing market thus limiting the growth.

The increase in pharmaceutical R&D has resulted in a sharp increase in the number of cell & gene therapy candidates under development. This has made it necessary to outsource manufacturing services to develop cost-effective and efficient cell & gene therapies.

The pharmaceutical industry, in particular, is R&D-intensive. Pharmaceutical companies invest in R&D to deliver high-quality and innovative products to the market. The trend suggests that the top pharma companies are increasing their R&D efficiencies through heavy R&D investments to see returns on their investment in the long run and through collaborative R&D efforts.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=180609441

Currently, there are 1,200 cell & gene therapies in trials worldwide. There are more than 700 investigational cell & gene therapies in clinical development in the US alone. However, manufacturing facilities have not kept up.

According to a 2020 PhRMA report on the cell & gene therapy pipeline in 2018, there were 289 cell & gene therapies in clinical development by biopharmaceutical companies. This number increased by 25% in 2020, with 362 cell & gene therapies in clinical development.

In addition to this, according to data released by CGT Catapult, there were 154 ATMP clinical trials ongoing in the UK in 2020 compared to the 127 trials reported in 2019, indicating an increase of more than 20%. This significant growth in the number of cell & gene therapy clinical trials is expected to drive the demand for manufacturing services and, in turn, propel growth in the cell & gene therapy manufacturing services market.

In 2020, the academic and research institutes segment accounted for the second largest share of the market by end users. Increase in life sciences R&D expenditure coupled with growing government support for research is driving the market growth for this segment.

The large share of the North American market is attributed to the rising government funding for R&D into personalized & efficient therapeutics, incidence of cancer and growing number of clinical trials for developing cell & gene therapies.

Key players in the cell & gene therapy manufacturing services market include Thermo Fisher Scientific (US), Merck KGaA (Germany), Charles River Laboratories (US), Lonza (Switzerland), Catalent (US), WuXi AppTec (China), Takara Bio Inc. (Japan), Nikon Corporation (Japan), FUJIFILM Holdings Corporation (Japan), F. Hoffmann-La Roche Ltd. (Switzerland), Oxford Biomedica plc (UK), and Cell and Gene Therapy Catapult (UK).