The development of therapies for key diseases, such as cancer, has attracted significant attention. Furthermore, increasing investments of pharmaceutical companies in the development of novel drugs is also fueling the market growth. However, significant operational costs are expected to negatively impact the cell & gene therapy manufacturing market thus limiting the growth.

It also resulted in control measures that impacted operations in life science organizations, such as production and research. In an article published by Nature Biotechnology, the CEO of Flagship Pioneering (US) stated that lab productivity at many of its research-based setups was running at just 30–50% capacity, and even upholding that rate was a challenge.

According to GEP Worldwide, more than 1,200 clinical trials across the globe were disrupted by June 2020. Nearly 61% of clinical trials were disrupted due to the suspension of patient enrolment. The impact varied due to changes in COVID-19 case volumes throughout the year, but the worst effect was seen in April 2020.

For More Info, Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=180609441

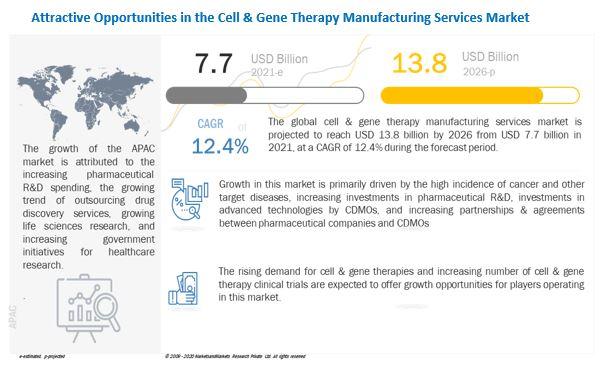

[299 Pages Report] The global cell and gene therapy manufacturing services size is projected to reach USD 13.8 billion by 2026 from USD 7.7 billion in 2021, at a CAGR of 12.4% during the forecast period. The market is primarily driven by the prevalence of cancer and other target diseases. The development of therapies for key diseases, such as cancer, has attracted significant attention.

Currently, there are 1,200 cell & gene therapies in trials worldwide. There are more than 700 investigational cell & gene therapies in clinical development in the US alone. However, manufacturing facilities have not kept up. It has been estimated that hundreds of facilities will be needed to manufacture the treatments that are now in clinical trials.

In 2020, cell therapy segment dominated the cell & gene therapy manufacturing services market. This can be attributed to the advent of new technologies and innovative products that have enabled several variety of cells such as hematopoietic stem cells (HSC), mesenchymal stem cells, natural killer cells, dendritic cells, and T-cells to treat diseases and conditions.

In 2020, North America accounted for the largest share of the cell & gene therapy manufacturing services market, followed by Europe and the Asia Pacific. The large share of the North American market is attributed to the rising government funding for R&D into personalized & efficient therapeutics, incidence of cancer and growing number of clinical trials for developing cell & gene therapies.

Key players in the cell & gene therapy manufacturing services market include Thermo Fisher Scientific (US), Merck KGaA (Germany), Charles River Laboratories (US), Lonza (Switzerland), Catalent (US), WuXi AppTec (China), Takara Bio Inc. (Japan), Nikon Corporation (Japan), FUJIFILM Holdings Corporation (Japan), F. Hoffmann-La Roche Ltd. (Switzerland), Oxford Biomedica plc (UK), and Cell and Gene Therapy Catapult (UK).