Currently, with the surge in cases of COVID-19, there is an increasing focus on personal hygiene and increasing production of medical nonwovens and single-use products, such as face masks and gloves. This, in turn, is expected to propel market growth in the next two years. On the other hand, concerns regarding the safety of reprocessed instruments are expected to limit market growth to some extent in the coming years.

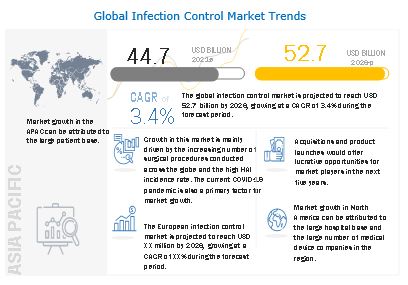

The growing number of medical device and pharmaceutical companies in emerging economies, increasing use of E-beam sterilization, re-introduction of ethylene oxide sterilization, and outsourcing operations to emerging countries with an improving healthcare sector will also support the growth of the infection control market in the coming years.

The COVID-19 outbreak has made personal and household disinfection increasingly important to prevent the spread of the disease. Cleaning product companies ramped up production, resulting in volume increases of sanitizer products upward of 60% (Source: American Cleaning Institute, 2020). Equipment sterilization plays a critical role in preventing the spread of COVID-19 in healthcare settings.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1084

The usage of reprocessed equipment to disinfect or sterilize medical devices is higher than normal during the pandemic since improper decontamination of surgical instruments, endoscopic devices, respiratory care devices, and reusable hemodialysis machines can increase the chances of COVID-19. This has increased the demand for sterilization consumables to ensure the proper sterilization of medical devices.

Over the years, there has been a significant rise in the number of surgical procedures performed worldwide. According to the WHO (2019), approximately 235 million major surgical procedures are performed worldwide every year. This is attributed to the growing prevalence of obesity and other lifestyle diseases, the rising geriatric population, and the increasing incidence of spinal injuries and sports-related injuries.

The growing number of surgical procedures performed has resulted in the increasing demand for different surgical equipment and medical devices during these procedures. This is expected to drive the demand for infection control products and services due to the proven benefits of sterilized products and growing awareness about their effectiveness in infection control health settings.

Most of the chemical disinfectants currently available in the market have toxic properties. For example, sodium hypochlorite is an effective treatment against blood-borne pathogens but is also highly corrosive and a respiratory irritant, which makes it dangerous for cleaning personnel and building occupants and toxic when released into the environment.

Due to the growing end-user population demanding a greener solution, the use of disinfectants is becoming limited, with their use being restricted to limited non-critical items and in lower amounts. Manufacturers are now being forced to develop newer, greener alternatives that are less corrosive to the human eyes, such as butyl-free, pH-neutral quaternary, and hydrogen peroxide-based disinfectants. In line with this, in 2018, Clorox Healthcare launched the new Clorox Healthcare Versa-Sure Cleaner Disinfectant Wipes that are alcohol-free.

Globally, the number of surgical procedures performed annually has increased significantly due to the rising geriatric population and the growing prevalence of obesity and diabetes. This has increased the demand for disposable medical products or single-use products that can be disposed of after use, reducing the chances of infection transmission.

The rising per capita healthcare spending and the increasing importance of maintaining hygiene and sterility are also expected to increase the demand for single-use medical nonwoven products. The outbreak of pandemics such as H1N1, SARS, and COVID-19 and viral diseases such as Zika virus, yellow fever, Ebola, and dengue has also increased the demand for single-use medical nonwoven products.

The Association for the Advancement of Medical Instrumentation has several working groups focusing on developing standards in several areas aimed to address the challenges involved in reprocessing medical devices.

The prominent players in Infection Control Market are STERIS plc. (US), Getinge AB (Sweden), Cantel Medical Corporation (US), Advanced Sterilization Products (US), 3M Company (US), Belimed AG (Switzerland), MMM Group (Germany), MATACHANA GROUP (Spain), Sotera Health LLC (US), Ecolab, Inc. (US), Metrex Research Corporation (US), Reckitt Benckiser Group Plc. (UK), Miele Group (Germany), Melag (Germany), and Pal International (UK).