Capital One has been providing its customers with a big bag full of exciting features. There are various kinds of features and benefits that Capital One Credit cards offer you no matter which one of its credit cards you decide to opt for. From jaw-dropping rewards for shopping to interest-free purchases, the sky is the limit when it comes to Capital One credit cards.

But simply owning a credit card doesn’t solve all your financial problems if you don’t understand the in-depth ways of proper account management. Capital One offers you the ability to set up an online account through the Capital One login page and conveniently manage your accounts.

HOW TO SET UP A CAPITAL ONE ONLINE ACCOUNT?

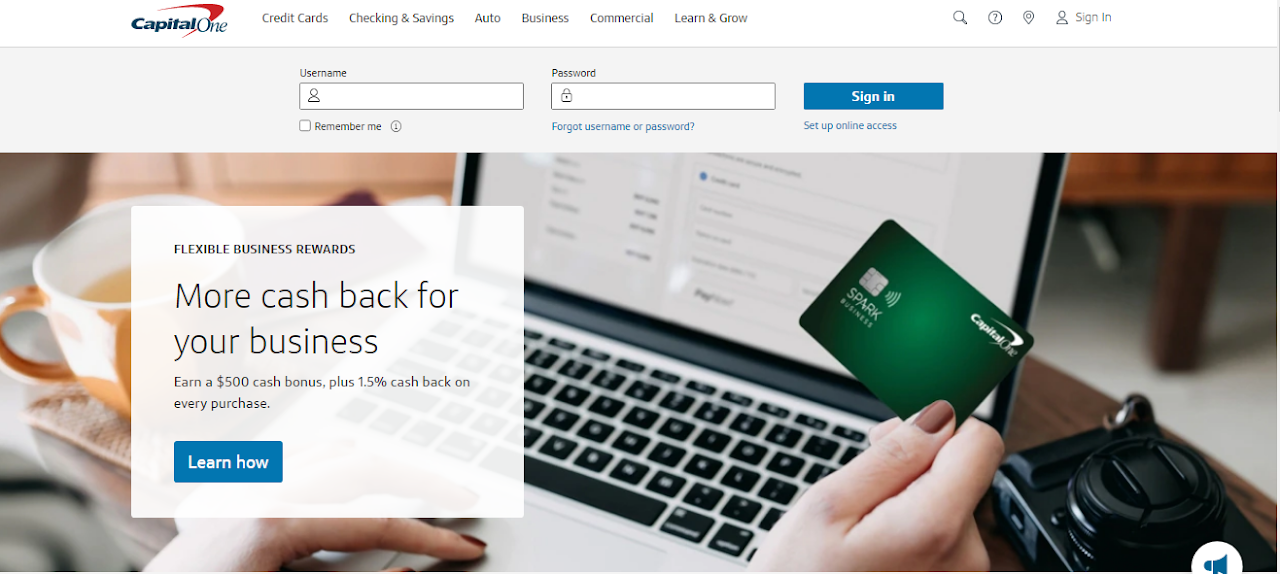

After receiving your Capital One credit card, you must ensure you have successfully activated it. To get started, go to Capital One's online banking enrollment page by simply clicking “Set up for online access” right under the blue sign-in button and follow the steps mentioned below.

1. Fill in your last name as mentioned on your card.

2. Provide your Social Security number as mentioned on the back of your card.

3. Enter your date of birth.

4. After providing the necessary required information, lastly, click on the blue button “Get Started” and continue with the rest of the information to finish your enrollment process.

You must visit Capital One's activation page and activate your account after signing up for online banking.

HOW TO LOG IN TO YOUR CAPITAL ONE ACCOUNT?

To sign in, enter your username and password on the Capital One login page. If you need to reset your username or password or if you have forgotten it, click the "Forgot Username or Password?" link.

HOW TO PAY YOUR CREDIT CARD BILL ONLINE?

To make a Capital One online payment, adhere to these steps:

1. Log on to your Capital One online account on the Capital One login page.

2. Click on “Pay Bill”.

3. Simply select "Choose Amount".

4. Select the online payment amount. You have the option of entering a custom amount or making the minimum payment required.

5. If this is your first time making a payment, enter your bank details, including your bank name and routing number.

6. Submit your Capital One credit card payment after your bank has been validated.

CONCLUSION

Credit cards provide a ton of features to you but it’s like a double-edged sword. If proper and effective management is not ensured while you are handling your credit card it can turn the tables on you financially. So, take the smart road ahead and plan your finances and manage your accounts effectively with Capital One.