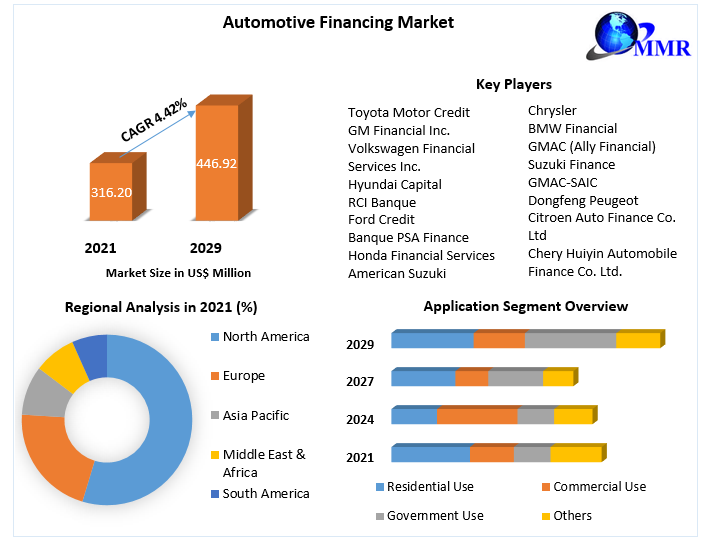

Global Automotive Financing Market was value US$ 316.20 Mn in 2021 and is expected to reach US$ 446.92 Mn by 2029 at a CAGR of 4.42 %.

Automotive Financing Market Overview:

The market report for Automotive Financing includes information on market share and company profiles for the leading international competitors along with a thorough analysis of the competition. The scope of the study includes a complete examination of the Automotive Financing Market as well as the factors influencing regional variations in the growth of the industry.

To remain ‘ahead’ of your competitors, request for a sample: https://www.maximizemarketresearch.com/request-sample/24825

Market Scope:

After market engineering, which included market statistics calculations, market size estimations, market predictions, market breakdown, and data triangulation, was complete, extensive primary research was carried out to gather data and confirm important figures. Throughout the market engineering process, top-down, bottom-up, and other data triangulation methodologies were routinely employed to conduct market estimates and forecasting for the general market segments and sub-segments detailed in this study. In order to provide vital information during the study, all data collected during the market engineering process is submitted to comprehensive qualitative and quantitative analysis.

Automotive Financing Market Segment:

The worldwide automobile finance market is primarily driven by rising cab service financing. Rising GDP growth rates and expanding populations in emerging economies are continuously boosting industry potential. The use of conventional automobiles is being constrained by growing environmental concerns brought on by elevated pollution levels and governmental mandates for car eco-monitoring. Additionally, initiatives like car sharing, corporate carpooling, and sector start-ups are defining the automotive industry and, consequently, the associated funding area.

The dependence of car purchases on the prognosis for the economy's future and the practical consumer buying confidence are obstacles that could impede the upward trend in the industry.

Automotive Financing Market Key players:

• Hyundai Capital

• RCI Banque

• Ford Credit

• Banque PSA Finance

• Honda Financial Services

• American Suzuki

• Fiat Finance

• Mercedes-Benz FS

• Chrysler

• BMW Financial

• GMAC (Ally Financial)

• Suzuki Finance

• GMAC-SAIC

• Dongfeng Peugeot Citroen Auto Finance Co. Ltd

• Chery Huiyin Automobile Finance Co. Ltd.

• Maruti Finance

• TATA Motor Finance

• Bank of America Corporation

• Ally Financial Inc.

• Hitachi Capital Asia Pacific Pte. Ltd.

• Capital One Financial Corporation

• Volkswagen Financial Services

To identify the market's leaders and project market revenue, primary and secondary research are both used. CEOs, marketing executives, and seasoned front-line employees were just a few of the notable thought leaders and subject matter experts that participated in the in-depth interviews for the main study. As a part of the primary study, extensive interviews with important thought leaders and business experts—including CEOs, marketing executives, and seasoned front-line staff—were conducted.

The secondary study included a review of the annual and financial reports of the major manufacturers. Secondary data is employed to calculate percentage splits, market shares, growth rates, and global market breakdowns. The results of these calculations are then put up against the original data in comparison. The Automotive Financing market is dominated by the following businesses:

For critical insights on this market, request for methodology here: https:/ /www.maximizemarketresearch.com/request-sample/24825

Regional Analysis:

The regional market research report for Automotive Financing also includes information on the specific market driving forces and changes in market legislation that have an impact on current and future market trends. Current and forthcoming trends are studied in order to evaluate the potential market as a whole and find profitable patterns to lay a stronger foundation. The evaluation of the regional market is built on the basis of the current environment and expected trends.

COVID-19 Impact Analysis on Automotive Financing Market:

A stop in activities between January 2020 and May 2020 resulted in a fall in the growth of end-user industries utilising Automotive Financing. These countries included Spain, France, Italy, China, the United States, the United Kingdom, and Spain. The market for Automotive Financing manufacturers as well as the profits of companies operating in these sectors consequently experienced a sharp decline. This affected the market's growth in 2020. Due to lockdowns and an increase in COVID-19 occurrences globally, end-user business demand for Automotive Financing has been severely decreased.

Key Questions Answered in the Automotive Financing Market Report are:

- Which market segment has the highest percentage of Automotive Financing in 2021?

- To what extent is there competition in the market?

- What are the primary factors influencing the growth of the Automotive Financing market?

- What portion of the market does region Automotive Financing control?

- What is the expected market CAGR from 2022 to 2029?

MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT Park Phase 2,

Pune Bangalore Highway,

Narhe, Pune, Maharashtra 411041, India.

Email: sales@maximizemarketresearch.com

Website: www.maximizemarketresearch.com