The report "Copper Clad Laminates Market by Application (Computers, Communication Systems, Consumer Appliances, Vehicle electronics, Healthcare Devices), Product Type (Rigid, Flexible), Reinforcement Material Type, Resin Type, Region - Global Forecast to 2027", size is estimated to be USD 16.4 billion in 2022 and is projected to reach USD 21.6 billion in 2027, at a CAGR of 5.7%.

The main forces behind the growth of the copper clad laminate market are growth in 5G infrastructure and the increasing use of PCBs across various applications. Rising raw material prices is a major market restraint. The technological shift in automotive sector to electric vehicles is a major opportunity in the copper clad laminate market. The biggest difficulties or challenge is the effect of supply chain disruption due to global chip shortage.

Browse in-depth TOC on "Copper Clad Laminates Market"

110 – Tables

39 – Figures

177 – Pages

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=100748480

By type, Rigid copper clad laminates accounted for the largest share.

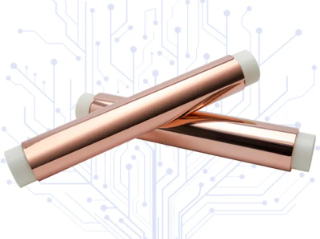

Copper clad laminate or CCL is a type of material used in PCBs. It is made using reinforcement materials like glass fiber, paper, or other materials, impregnated with resin adhesive like epoxy, phenolic etc. and covered with copper foil on either side or one side. The Copper clad laminates Market has been segmented based on its type i.e., rigid copper clad laminate and flexible copper laminate. The rigid laminates are used in several end-use applications including consumer electronics, communications, automotive, and aerospace industries. The rigid copper clad laminates dominate the market owing to its wide application base, enhanced properties, strength and durability.

By reinforcement material, glass fiber accounted for the largest market share.

The Copper clad laminates market has been segmented based on the reinforcement material. The market is segmented as fiber glass, paper base and compound materials as per the reinforcement material used in the copper clad laminates. The fiberglass reinforcement material segment of the market dominates the market. The high market share is mainly driven by its application in different electronic products as it provides better electronic performance and cost-effectiveness.

By resin type, epoxy accounted for the largest market share.

The Copper clad laminates market has been segmented based on the resins used in the copper clad laminates i.e., epoxy, phenolic, polyimide and others. Epoxy is the most common resin used in copper clad laminates. Due to a wide application base like home appliances, IT peripherals, consumer electronics, and electronic communication systems, it dominates the market. Paper-phenolic copper clad laminates are cost effective. It is used in IT peripherals, communication systems and consumer electronics.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=100748480

By Application, communication systems accounted for the largest share in 2021.

Copper clad laminates can be used in a variety of applications like computers, communication systems, consumer appliances, vehicle electronics, healthcare devices and defense technology. According to projections, the communication systems will be the biggest market for copper clad laminates. The market for 5G infrastructure is expanding as a result of rising acceptance of virtual networking in the telecom industry, lower latency in 5G, and an increase in mobile traffic data. High consumer demand and industrial automation generates increased demands for effective communication systems which drives the market for copper clad laminates.

APAC is projected to account for the largest share of copper clad laminates in 2021

The largest market for copper clad laminates is anticipated to be in APAC over the projected period. China, Taiwan, South Korea and Japan are the main contributors in the same. The growth is led by rapid increasing demand for copper clad laminates from various industries, including computers, communication systems, consumer appliances, vehicle electronics, healthcare devices etc. The investments in 5G infrastructure and technological shift in automobile sector to electric vehicles is a major reason for growth of copper clad laminate market.

Get 10% Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=100748480

Some of the key players in the global copper clad laminates market are Kingboard Laminates Holdings Ltd. (China), Shengyi Technology Co., Ltd (China), Nan Ya Plastics Corporation (Taiwan), Panasonic Holdings Corporation (Japan), Taiwan Union Technology Corporation (Taiwan) and others.

Kingboard Laminates Holdings Ltd. (China) manufactures copper clad laminates and produces component materials such as copper foil, glass yarn, glass fabric, bleached kraft paper, epoxy resin, and glass fabric. The group also manufactures laminate goods, such as glass epoxy and flame-resistant paper laminates. The group runs more than 20 factories in southern and eastern China. The company also produces and sells chemicals, glass fabric, bleached kraft paper, and other products through its subsidiaries.

Shengyi Technology Co., Ltd (China), is a manufacturer of electronic circuit base materials. The company produces high-end electronic materials such as CCL, prepreg, insulation boards, metal-based CCL, resin-coated copper (RCC). Products are mostly used to create multi-layer boards and PCBs with single and double sides. The company has headquarters in China.

Nan Ya Plastics Corporation (Taiwan), manufacturers plastic products, chemicals, electronic materials, fibres & textiles, and machinery & switchgear. It is a major producer of copper clad laminates and polyester fibres for use in electronic materials. The products manufactured find use in different industries such as transport materials, household items, building material coatings, 3C appliances, industrial applications, civil farms, outdoor sports, etc. The company has operations in China with dealers worldwide.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=100748480