An Enterprise Stability Navigator is designed for organizations operating in environments where balance can change as quickly as odds at a casino https://austarclub-aus.com/ table, and where small miscalculations cascade into structural instability. According to KPMG’s 2024 global survey, 58 percent of large enterprises experienced at least one operational destabilization event in the past 18 months, ranging from liquidity strain to systemic delivery failures. Stability navigation systems emerged as a response, integrating financial resilience, operational load, and external pressure into a single adaptive model.

Stability is not the absence of change but the ability to absorb it. A diversified industrial group with revenues exceeding $6.3 billion reported that its navigator identified stress accumulation across three divisions that individually looked healthy. By rebalancing capital expenditure and workforce allocation, the company avoided a projected 4.6 percent decline in return on assets. Economists at the University of Zurich emphasize that instability often emerges from synchronization, when multiple moderate stresses align in time rather than severity.

The navigator continuously measures tolerance thresholds. When cash conversion cycles extend by more than 6 days while supplier concentration exceeds 38 percent, instability risk rises sharply. A North American retailer operating 1,200 locations used stability analytics to prioritize store-level interventions, reducing forced closures by 19 percent during a demand downturn. According to EY, enterprises with quantified stability metrics recover from disruptions 31 percent faster than those relying on lagging financial indicators.

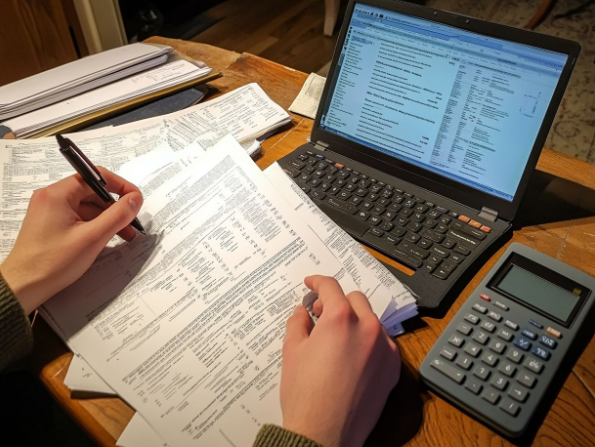

Social validation underscores real-world relevance. On LinkedIn, a CFO from Chicago shared that stability dashboards replaced “gut feel” crisis calls with structured response playbooks. A widely shared comment highlighted how early stability alerts prevented emergency borrowing at unfavorable rates, saving approximately $12 million annually. On internal corporate networks, managers report reduced firefighting once pressure points became visible weeks in advance.

Stability navigation reframes leadership focus. Instead of chasing growth signals while hoping the foundation holds, executives can see where equilibrium is thinning. In markets where revenue volatility of 8 to 12 percent is now common, stability becomes an active discipline. Enterprises that treat it as navigable terrain rather than static condition gain the ability to move confidently without risking structural collapse.

Stability is not the absence of change but the ability to absorb it. A diversified industrial group with revenues exceeding $6.3 billion reported that its navigator identified stress accumulation across three divisions that individually looked healthy. By rebalancing capital expenditure and workforce allocation, the company avoided a projected 4.6 percent decline in return on assets. Economists at the University of Zurich emphasize that instability often emerges from synchronization, when multiple moderate stresses align in time rather than severity.

The navigator continuously measures tolerance thresholds. When cash conversion cycles extend by more than 6 days while supplier concentration exceeds 38 percent, instability risk rises sharply. A North American retailer operating 1,200 locations used stability analytics to prioritize store-level interventions, reducing forced closures by 19 percent during a demand downturn. According to EY, enterprises with quantified stability metrics recover from disruptions 31 percent faster than those relying on lagging financial indicators.

Social validation underscores real-world relevance. On LinkedIn, a CFO from Chicago shared that stability dashboards replaced “gut feel” crisis calls with structured response playbooks. A widely shared comment highlighted how early stability alerts prevented emergency borrowing at unfavorable rates, saving approximately $12 million annually. On internal corporate networks, managers report reduced firefighting once pressure points became visible weeks in advance.

Stability navigation reframes leadership focus. Instead of chasing growth signals while hoping the foundation holds, executives can see where equilibrium is thinning. In markets where revenue volatility of 8 to 12 percent is now common, stability becomes an active discipline. Enterprises that treat it as navigable terrain rather than static condition gain the ability to move confidently without risking structural collapse.

An Enterprise Stability Navigator is designed for organizations operating in environments where balance can change as quickly as odds at a casino https://austarclub-aus.com/ table, and where small miscalculations cascade into structural instability. According to KPMG’s 2024 global survey, 58 percent of large enterprises experienced at least one operational destabilization event in the past 18 months, ranging from liquidity strain to systemic delivery failures. Stability navigation systems emerged as a response, integrating financial resilience, operational load, and external pressure into a single adaptive model.

Stability is not the absence of change but the ability to absorb it. A diversified industrial group with revenues exceeding $6.3 billion reported that its navigator identified stress accumulation across three divisions that individually looked healthy. By rebalancing capital expenditure and workforce allocation, the company avoided a projected 4.6 percent decline in return on assets. Economists at the University of Zurich emphasize that instability often emerges from synchronization, when multiple moderate stresses align in time rather than severity.

The navigator continuously measures tolerance thresholds. When cash conversion cycles extend by more than 6 days while supplier concentration exceeds 38 percent, instability risk rises sharply. A North American retailer operating 1,200 locations used stability analytics to prioritize store-level interventions, reducing forced closures by 19 percent during a demand downturn. According to EY, enterprises with quantified stability metrics recover from disruptions 31 percent faster than those relying on lagging financial indicators.

Social validation underscores real-world relevance. On LinkedIn, a CFO from Chicago shared that stability dashboards replaced “gut feel” crisis calls with structured response playbooks. A widely shared comment highlighted how early stability alerts prevented emergency borrowing at unfavorable rates, saving approximately $12 million annually. On internal corporate networks, managers report reduced firefighting once pressure points became visible weeks in advance.

Stability navigation reframes leadership focus. Instead of chasing growth signals while hoping the foundation holds, executives can see where equilibrium is thinning. In markets where revenue volatility of 8 to 12 percent is now common, stability becomes an active discipline. Enterprises that treat it as navigable terrain rather than static condition gain the ability to move confidently without risking structural collapse.

0 Comments

0 Shares