Fraud analytics is the efficient use of data analytics and related business insights developed through statistical, quantitative, predictive, comparative, cognitive, and other emerging applied analytical models for detecting and preventing healthcare fraud.

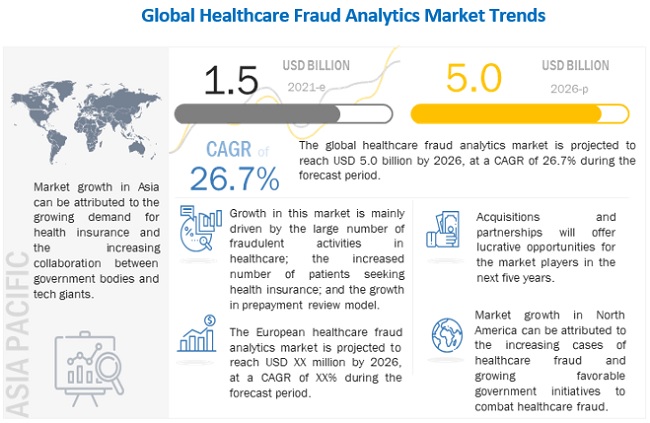

The global healthcare fraud analytics market is projected to reach USD 5.0 billion by 2026 from USD 1.5 billion in 2021, at a CAGR of 26.7% during the forecast period. Market growth can be attributed to a large number of fraudulent activities in healthcare, increasing number of patients seeking health insurance, high returns on investment, and the rising number of pharmacy claims-related frauds.

The global healthcare fraud analytics market is facing a plethora of challenges. Travel bans and quarantines, halt of indoor/outdoor activities, temporary shutdown of business operations, supply demand fluctuations, stock market volatility, falling business assurance, and many uncertainties are somehow exerting a partial negative impact on the business dynamics.

Many healthcare providers and specialists have been observed to be engaged in fraudulent activities, for the sake of profit. In the healthcare sector, fraudulent activities done by patients include the fraudulent procurement of sickness certificates, prescription fraud, and evasion of medical charges.

A couple of reasons contributing to the growth of the health insurance market include the rise in the aging population, growth in healthcare expenditure, and increased burden of diseases. In the US, the number of citizens without health insurance has significantly decreased, from 48 million in 2010 to 28.6 million in 2016. In 2017, 12.2 million people signed up for or renewed their health insurance during the 2017 open enrollment period (Source: National Center for Health Statistics).

Download PDF Brochure With Latest Edition @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=221837663

This growth is aided by the increasing affordability of health insurance for the middle class in this region and the rising awareness regarding the benefits of health insurance. In the UAE, as per a new regulatory policy (2017), any citizen residing and working in the UAE needs to be insured medically. Such regulatory changes in the buying behavior of employers (from employer-based plans to providing individual spending allowances to the staff) are driving the health insurance market in the region.

The healthcare industry is changing at an incredible rate, and one of the major contributors to this change is the increasing popularity of healthcare communication through social media. Not only has social media become a place where people seek health information, but social media channels also allow for two-way public communication between patients, providers, and other third parties. This helps create a large forum for health discussions globally.

The deployment of fraud analytics solutions is a time-consuming process. The process involves creating user interfaces, new databases, and predictive models; evaluating and deploying models, and monitoring their effectiveness. In this process, data analysts continuously run algorithms until they get the most effective predictive model.

Get Data as per your Format and Definition | REQUEST FOR CUSTOMIZATION: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=221837663

This means they must start the same process again with new data. Thus, if data analysts fail at one stage, the whole process is disturbed. Furthermore, the software requires frequent upgrades, as fraudsters constantly change tactics. This adds to the total cost of fraud analytics solutions.

Descriptive analytics forms the base for the effective application of predictive or prescriptive analytics. Hence, these analytics use the basics of descriptive analytics and integrate them with additional sources of data in order to produce meaningful insights.

The increasing number of patients seeking health insurance, the rising number of fraudulent claims, and the growing adoption of the prepayment review model are expected to drive the growth of this segment in the coming years.

The high share of the North American market is attributed to the large number of people having health insurance, growing healthcare fraud, favorable government anti-fraud initiatives, the pressure to reduce healthcare costs, technological advancements, and greater product and service availability in this region. Moreover, a majority of leading players in the healthcare fraud detection market have their headquarters in North America.