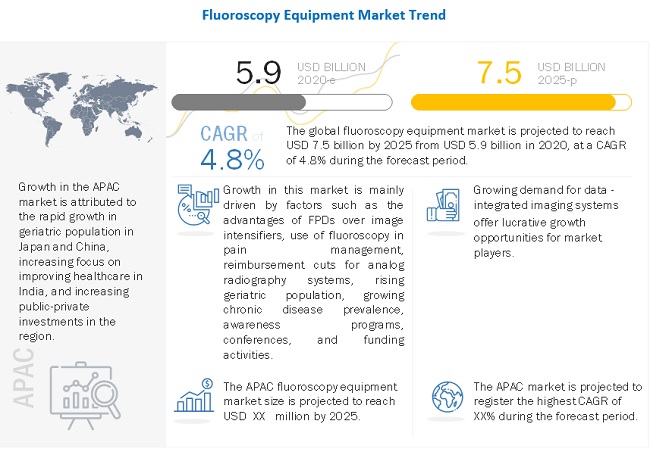

The market for fluoroscopy equipment is expected to grow from USD 5.9 billion in 2020 to USD 7.5 billion by 2025, at a CAGR of 4.8% during the forecast period. Growth in the fluoroscopy equipment market is attributed to factors such as advantages of FPDs over image intensifiers, the use of fluoroscopy in pain management, reimbursement cuts for analog radiography systems, rising geriatric population, and the growing prevalence of chronic diseases.

The COVID-19 pandemic has significantly impacted the buying capacity of hospitals, especially small-scale hospitals and scanning centers. According to an article in the Livemint, private hospitals in India have faced revenue losses of up to 90% due to the COVID-19 pandemic. The pandemic has also impacted the operation of manufacturing companies.

The evolution of fluoroscopy systems and C-arms from traditional X-ray image intensifier technology to digital flat-panel detectors (FPDs) has brought about significant advancements in fluoroscopic imaging. FPDs have a number of advantages over image intensifiers, including compact sizes and reduced radiation dose. Systems with FPDs have the potential for higher image resolution than their predecessors.

FPDs offer no image distortion, greater sensitivity, and better patient coverage. Due to their advantages, many hospitals are now opting for FPD fluoroscopes. The growing preference for advanced technologies, and the need to shift to new, more efficient products, will be a key factor driving the growth of this market segment.

Download PDF Brochure With Latest Edition @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=23056341

Fluoroscopic procedures can result in high radiation dose exposure for complex procedures, such as stent placement. These procedures are time-consuming, which greatly increases the radiation that patients are exposed to and the risk of hazards such as radiation-induced injuries to the skin and underlying tissues. The long-term side-effects of prolonged radiation exposure can also include cancer.

This has served to push users towards non-radiation modalities, particularly in the case of pediatric patients. For instance, the ACR (American College of Radiology) Appropriateness Criteria specify that for infants younger than two months, ultrasound should be considered before a fluoroscopic examination. Additionally, CT examinations can completely eliminate the need for a fluoroscopic examination, as a CT scan is noninvasive as opposed to the minimally invasive fluoroscopic imaging.

Many hospitals in developing countries are unable to invest in fluoroscopy equipment due to their high costs, poor reimbursement rates, and budget constraints, and therefore prefer refurbished systems. These systems are less expensive than new systems—approximately 40% to 60% of the original price.

Increasing demand for refurbished devices poses a major challenge to the sales of new instruments—and, subsequently, to the growth of market players and small manufacturers.

Get Data as per your Format and Definition | REQUEST FOR CUSTOMIZATION: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=23056341

These systems come with a software package that helps store patient information. With the help of data integration, physicians can easily compare scans to effectively observe disease progression.

To devise a treatment plan, clinicians are demanding access to integrated, comprehensive data on the patient’s diagnostic history.

In addition to data integration, there lies a huge opportunity for making data available through mobile technologies. This will help doctors to view and study scans wherever they are. Due to their advantages, convenience, and huge demand from clinicians, data integrated systems offer a huge opportunity for market growth.

The rising prevalence of cardiovascular diseases and the increasing number of orthopedic surgeries are some of the major factors driving the growth of the mobile C-arms market. C-arms are used for a wide range of applications, including surgeries for cardiovascular diseases, neurosurgeries, and surgeries for gastroenterology, orthopedics, traumatology, and urology disorders.

Cardiology is the largest diagnostic application segment of the fluoroscopy equipment market. The large share of this segment is attributed to the high burden of cardiovascular diseases (CVDs) worldwide and the convenience and better results offered by fluoroscopy systems during the diagnosis and treatment of various cardiac disorders.

Key Market Players

The major players in the fluoroscopy equipment market are Siemens Healthineers (Germany), GE Healthcare (US), and Philips (Netherlands). These companies together accounted for a share of ~80% of the fluoroscopy equipment market in 2018. Other players in the market include Shimadzu Corporation (Japan), Ziehm Imaging GmbH (Germany), Toshiba Medical Systems Corporation (Japan), Hitachi Ltd. (Japan), Carestream Health, Inc. (US), Hologic, Inc. (US), Lepu Medical Technology Co., Ltd. (China), Agfa-Gevaert Group (Belgium), and ADANI Systems Inc. (Belarus) among others.