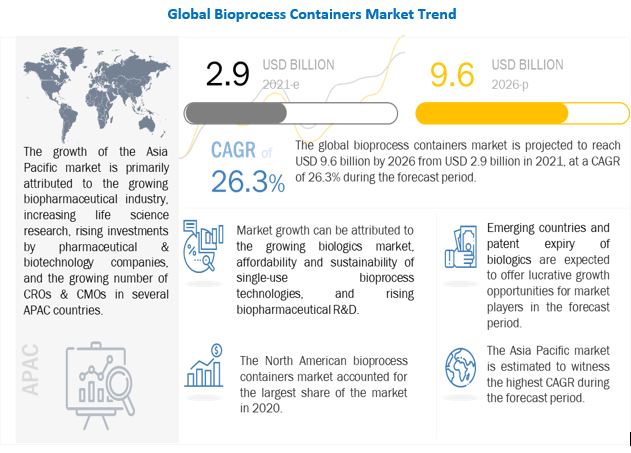

The global bioprocess containers (BPCs) market is projected to grow from USD 2.9 billion in 2021 to USD 9.6 billion by 2026, at a CAGR of 26.3% during the forecast period. Growth in the bioprocess containers market is mainly driven by factors such as the growing biologics market, affordability and sustainability of single-use bioprocess technologies, and rising biopharmaceutical R&D. Emerging countries and the patent expiry of biologics are expected to offer growth opportunities for players operating in the bioprocess containers market during the forecast period.

With the World Health Organization (WHO) officially declared the outbreak of the virus as a pandemic, a mix of established pharmaceutical companies, as well as players in the bioprocess containers market, have stepped forward to develop treatments and vaccines that target the infection caused by the novel coronavirus.

Therefore, the growing adoption of single-use technologies for COVID-19 pandemic-related research, coupled with increasing vaccine development by key players, is expected to have a positive impact on the bioprocess containers market.

The growth of single-use technologies can be attributed to the growing need for better, cheaper, and faster biologics production. Active development of individualized biologics and personalized medicines, including patient-specific cellular & gene therapies and therapeutic vaccines, demands high sterility and is therefore manufactured using single-use equipment and consumables.

In recent years, more biologics having higher potency that require smaller production volumes, advancements in biosimilars targeting smaller markets, and ongoing improvements in production yields and efficiencies that create production operations at much smaller scales have increased the use of single-use technologies such as single-use bioprocess containers/bags as they are best suited for small volume productions.

Download PDF Brochure With Latest Edition @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=107645832

Additionally, the Centre for Biologics Evaluation and Research’s (CBER) (2021-25) strategic plan involves various schemes for boosting the growth of the biologics market. With increasing growth in the biologics market, the number of bioprocess containers needed for R&D and biologics manufacturing is also expected to increase in the coming years.

Compared to traditional bio-manufacturing technologies, single-use systems (SUS) have many advantages, such as reduced requirements for process validation and higher manufacturing flexibility, which ultimately results in higher operating efficiency and reduced manufacturing costs. Despite these advantages, there is a possibility that the plastic materials used for SUS may leach organic compounds or inorganic substances into the processing fluid or the final drug product, which remains a major concern. Such an undesired change could eventually compromise bioprocessing and might significantly impact the safety, quality, and purity of the drug product.

Extractables are compounds that can be extracted from source materials using appropriate solvents under vigorous laboratory conditions, while leachables are compounds present in drug products caused by leaching from containers, closures, and processing components. Therefore, leachables can be considered a subset of extractables. Extractables and leachables are commonly associated with polymeric and elastomeric materials due to the use of additives to increase stability and aid in the formation of material components.

According to a survey conducted by BioPlan Associates in 2018, 73.3% of respondents agreed that leachables and extractables are major concerns that may limit the use of bioprocessing in the near future. As single-use assembly products are made of processed plastic materials, they often face the problem of contamination from the container due to leachables.