In today's digital age, managing your finances has never been easier, thanks to the convenience of online banking. Capital One, one of the leading financial institutions in the United States, offers its customers a user-friendly and secure online platform for managing their accounts. In this article, we will guide you through the Capital One login process, explore the benefits of online banking, and provide answers to some common questions.

1. Introduction to Capital One Login

Capital One is a renowned financial institution known for its commitment to innovation and customer satisfaction. Their online banking platform allows customers to access and manage their accounts conveniently from anywhere with an internet connection.

2. Setting Up Your Capital One Account

Before you can access your account online, you need to set it up. Visit the Capital One Login website and click on the "Sign Up" or "Get Started" button. Follow the prompts to enter your personal information, create a username and password, and verify your identity.

3. The Capital One Mobile App

For those on the go, Capital One offers a mobile app for both iOS and Android devices. Download the app from your device's app store, log in with your credentials, and access your accounts with ease.

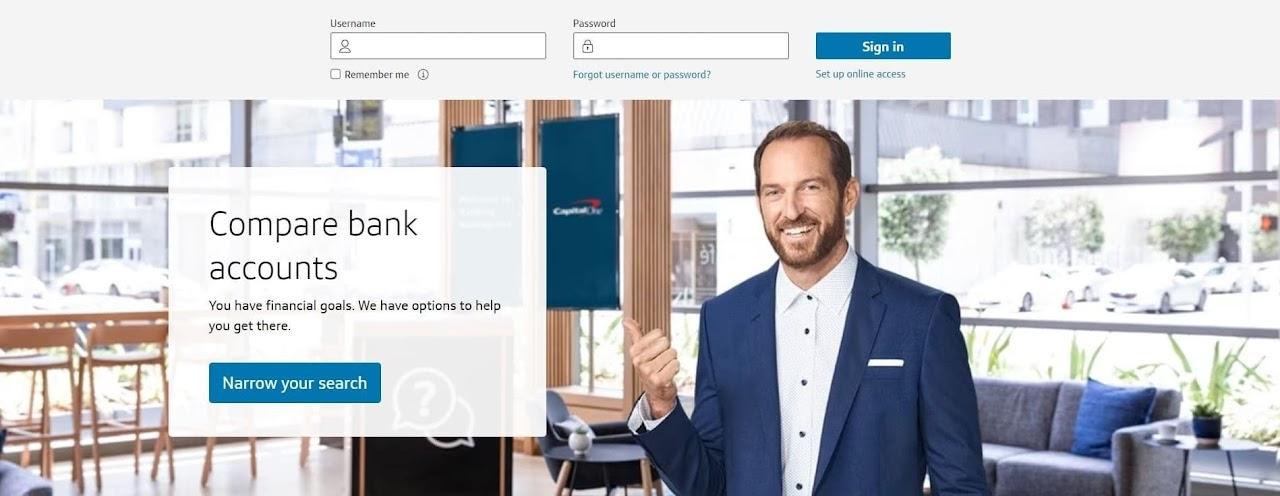

4. Logging In to Your Capital One Account

To log in to your Capital One account, visit the official website or open the mobile app. Enter your username and password, then click the "Log In" button.

5. Navigating Your Capital One Dashboard

Once logged in, you will be greeted by your personalized dashboard. Here, you can see an overview of your accounts, balances, and recent transactions.

6. Managing Your Accounts

Capital One's online banking platform allows you to manage multiple accounts, including checking, savings, credit cards, and loans, all in one place. Click on the respective account to view details and perform transactions.

7. Transferring Funds

Need to transfer money between accounts or to another Capital One customer? The online platform offers a seamless fund transfer feature. Just select the accounts, specify the amount, and confirm the transfer.

8. Paying Bills Online

Say goodbye to writing checks and mailing bills. Capital One's online banking enables you to pay your bills electronically. Add payees, schedule payments, and keep track of your payment history effortlessly.

9. Viewing Statements and Transactions

Access your account statements and transaction history anytime you need them. Easily monitor your spending patterns and account activity through the online portal.

10. Security Measures

Capital One takes the security of your financial information seriously. They employ state-of-the-art encryption and multi-factor authentication to safeguard your data.

11. Troubleshooting Login Issues

If you ever encounter login issues, such as a forgotten password, Capital One provides step-by-step instructions to help you regain access to your account.

12. Contacting Capital One Support

Should you require assistance beyond self-service options, Capital One offers customer support through phone, email, and chat. Their knowledgeable staff is ready to assist you with any inquiries.

13. Frequently Asked Questions (FAQs)

Q1: Is online banking with Capital One safe?

Yes, Capital One Login employs advanced security measures to protect your financial data, including encryption and multi-factor authentication.

Q2: Can I access my Capital One account on multiple devices?

Yes, you can access your account on the web and through the mobile app on multiple devices for your convenience.

Q3: Are there any fees for using Capital One's online banking services?

Capital One provides many free online banking services, but some premium features may have associated fees. Check their website for details.

Q4: What should I do if I suspect unauthorized activity on my account?

Contact Capital One's customer support immediately to report any suspicious activity and secure your account.

Q5: Can I set up account alerts to monitor my account activity?

Yes, you can set up customized account alerts to stay informed about account transactions and balances.

14. Conclusion

Capital One login provides a hassle-free way to manage your finances efficiently. With its user-friendly interface, robust security features, and convenient mobile app, you have the power to take control of your financial future. Access your account today and experience the convenience of online banking. "Coinb"

15. Access Now

Take the first step towards simplified banking. Access your Capital One account now and enjoy the benefits of easy online management.

In conclusion, Capital One's online banking platform offers a range of features that make managing your finances a breeze. From checking your balances to paying bills and transferring funds, it's all at your fingertips. If you have any more questions or need assistance, don't hesitate to reach out to Capital One's dedicated support team.