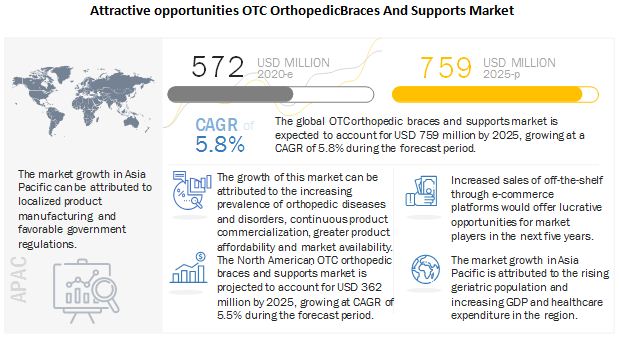

Growth in the OTC orthopedic braces and supports market is driven primarily by the increasing prevalence of orthopedic diseases & disorders, continuous product commercialization, market availability & product affordability, rising number of sports & accident-related injuries, and growing public awareness related to preventive care are driving the growth of the orthopedic braces and supports market.

COVID-19 Impact on the global OTC orthopedic braces and supports market

The OTC orthopedic braces and supports market is impacted due to the pandemic, resulting in short term negative growth due to factors such as a sharp decline in elective surgeries and ban on organized sports. Moreover, O&P clinics were temporarily closed, and hospital access restricted to non-essential care. Thus, limited access to clinics, social distancing, the lockdown of the population, which results in less trauma and workplace injuries, and slow-down in patient flow and referrals has also impacted the market growth.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=113271585

OTC Orthopedic braces and supports are increasingly being used during clinical management of various orthopedic diseases and disorders such as osteoarthritis, rheumatoid arthritis, osteoporotic fractures, and carpal tunnel syndrome.

The incidence of orthopedic diseases and disorders is expected to increase further in the coming years with the increasing prevalence of obesity and related lifestyle disorders, as obese individuals are at a higher risk of orthopedic & musculoskeletal injuries as well as diabetes.

While customized and pre-fabricated braces are available on prescription worldwide, the currently available OTC braces are not as flexible. Patients with higher or lower arches, greater physical activity, specific shoe fit issues, or significant bone or tendon problems (as opposed to typical standards) mostly prefer prescription orthopedic braces (compared with OTC products).

OTC orthopedic braces have to be replaced every few months (as compared to prescription orthotics that last for years with minimal refurbishment). Thus, the lack of customization options for OTC orthopedic braces is one of the major factors responsible for restricting the wider adoption of OTC orthopedic braces and supports during the forecast period.

Governments and insurance bodies across major countries increasingly recognize the effective patient care offered by such products and are thus supportive of online sales, higher reimbursement, and insurance coverage.

Topical, oral, and parenteral pain medications are used widely for the effective management of pain associated with musculoskeletal disorders such as tendinitis, carpal tunnel syndrome, and osteoarthritis.

The growth of the knee braces and supports segment is attributed to the several benefits offered by these products, such as medial and lateral support, reduced rotation of the knee, limited injury during motion, and protection from the post-surgical risk of injury.

The favorable reimbursement scenario for knee braces in developed countries, growing geriatric & obese population (which are at a higher risk of developing osteoarthritis and other knee-related conditions), and the increasing number of sports injuries are other factors driving the growth for knee braces and supports.

Orthopedic braces and supports are used to reduce the clinical risk of musculoskeletal injuries and diabetic foot ulcers, among other preventive care applications. These braces are used by athletes & sportspersons to minimize the risk of sports-related musculoskeletal injuries (such as ACL tears, hairline fractures, ankle sprains, hamstring strains, and tennis elbow).

The growth of this market segment is majorly driven by the wide availability of orthopedic bracing products through retailers & pharmacies, rising adoption of off-the-shelf products for sprain & ligament injuries in major countries (as a result of the ease of product access to patients through retailers & pharmacies), and the growing public awareness about the clinical benefits of orthopedic braces in preventive care.

Key Market Players In OTC Braces & Supports Market

3M (US), Bauerfeind AG (Germany), DJO Finance LLC (US),BSN Medical (Germany), and Össur Hf (Iceland) are the top five players in the global OTC orthopedic braces and supports market. Other prominent players operating in this market include Breg, Inc. (US), , DeRoyal Industries, Inc. (US), Zimmer Biomet Holdings, Inc. (US), Ottobock Holding GmbH & Co. KG (Germany), Bird & Cronin, Inc. (US), Neo G (UK), Mueller Sports Medicine (US), medi GmbH & Co. KG (Germany), BSN medical (Germany), Thuasne Group (France), Becker Orthopedic (US), and Trulife (Ireland).